As buyers and other participants in the commercial insurance marketplace have seen, market conditions are firming quickly in virtually all lines other than worker’s compensation. Automobile liability rates have been rising for a number of years and more recently, this has spread to other liability coverages perhaps none more rapidly and dramatically impacted than umbrella liability programs.

A robust economy has led to demonstrative increases in recent years in statistics around total miles driven in the US, while simultaneous near-zero inflation in many industries has led to some fleet owners having to employ less experienced drivers. Combine this with known issues like distracted driving, increased physical damage costs from broader inclusion of technology in vehicle exteriors (there is no such thing as a “fender bender” in a world in which virtually every bumper has cameras and sensors), and the resultant growth in automobile liability claim frequency is easy to understand. However, the spike in severity has been astonishing, even to experienced industry observers, and is driving rapid change in the umbrella marketplace.

Catchphrases including “social justice” and “social inflation” reflect an already aggressive and increasingly emboldened and well-financed (including from a notable rise in litigation financing) plaintiffs’ bar, monetizing a burgeoning trend in American society that seeks to hold corporations and their insurers more financially responsible. Juries have grown numb to delivering nine-figure verdicts, and the fear of juror unpredictability is driving settlements to record levels.

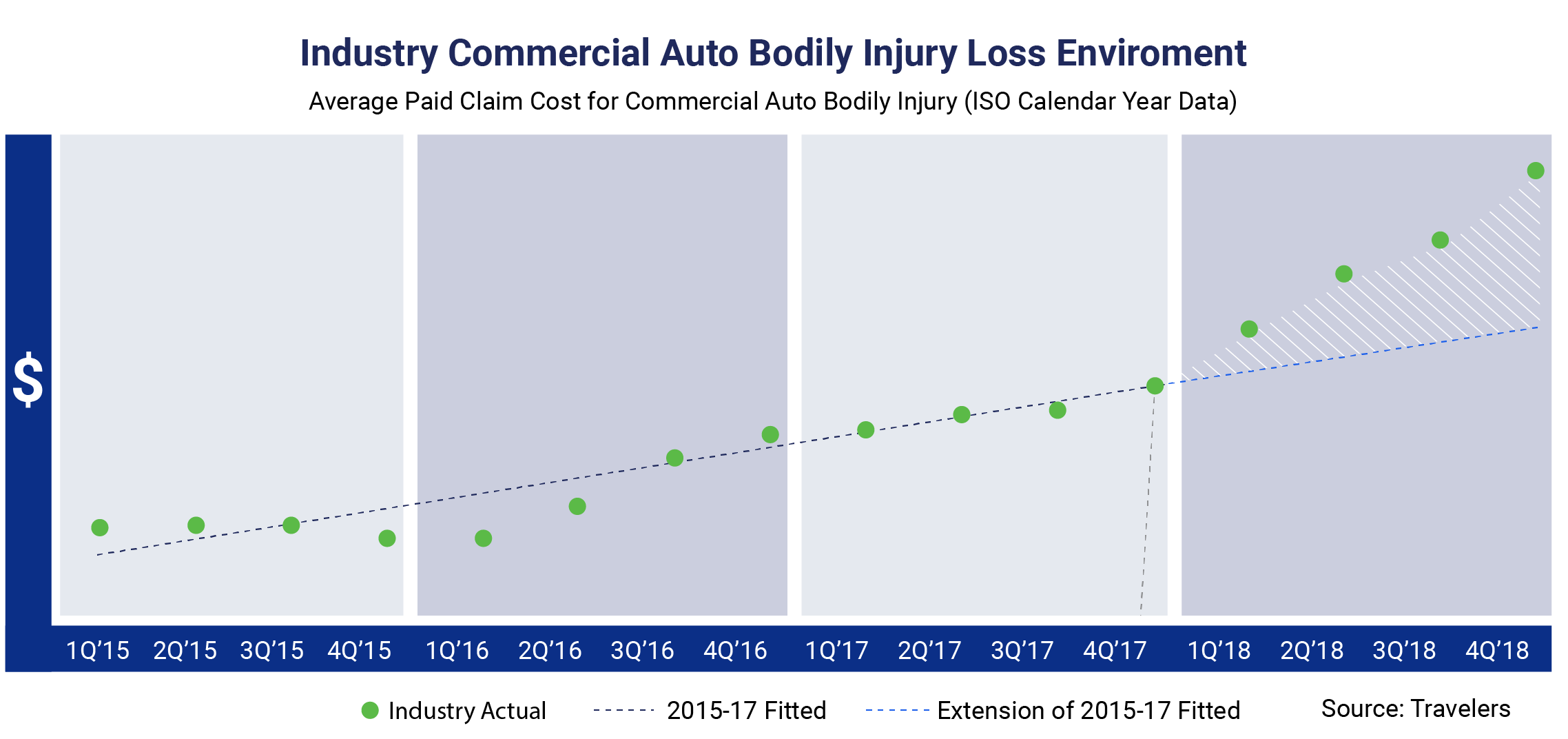

Automobile liability loss costs for the industry have been on the rise for some time, and insurance rates have reacted to some extent in recent years, but just in recent quarters, the spike in so-called “nuclear verdicts” has been remarkable. In their most recent quarterly earnings release, Travelers shared the graphic below which demonstrates this spike through 2018, and our anecdotal evidence suggests that the curve has continued or likely steepened through 2019. Simkiss & Block has heard of at least a dozen $25,000,000+ automobile liability judgments in the past few quarters alone, including one for $280,000,000.

CNA Insurance cited some of this also in their most recent earnings release when they said that very recently they have seen “consistently higher severity on our Auto claims.” CNA’s arithmetic also shows that automobile price increases of recent years haven’t come close to keeping pace with the dramatic rise in claim values over that period. In this same earnings release, CNA’s CEO, Dino Robusto, reflected that the industry has “experienced almost four years of rate changes being lower than long run loss cost trends starting early 2015.” He continued,

“All else equal, we would have to sustain the current rate levels through mid-2021 to make up, if you will, the lost ground and pricing. We now believe it is more likely that rate increases running above our loss cost trends will persist throughout 2020, is quite rational in light of the lost ground, and the pressure on loss cost trends.”

As noted above and previously, the effect of these trends have been seen in pricing of primary automobile insurance for a number of years now but the spike in severity (and the “frequency of severity”) has roiled umbrella insurers throughout 2019 and now into 2020. The three common impacts we are seeing on lead umbrella renewals are:

- Reduction in limits – $25,000,000 lead umbrellas are very commonly being renewed at just $10,000,000 and for accounts with higher hazard exposures, substantial fleets or claim problems it isn’t unusual to see the renewal premium for $10,000,000 be close to or above the expiring premium for $25,000,000.

- Increase in attachment point – While buyers with larger fleets may have had (or been forced in recent years to take) primarily automobile limits of $2,000,000 or more, the standard automobile liability attachment point for middle market umbrellas has remained at $1,000,000 for decades. Given all the reasons noted earlier for sharp increases in loss costs, umbrella carriers are increasingly saying they need the higher attachment in order for their involvement to continue to be limited to the traditional “catastrophe” claims.

- Increase in premiums – Underlying premiums are typically the primary driver of umbrella and excess premiums and with general liability and automobile liability rates rising across the board, it is no surprise to see umbrella premiums increasing sharply. Even if underlying premiums weren’t rising quickly (which they are), the rapid increases in loss costs combined with negligible investment income in an extended period of near-record-low interest rates, would suggest that rates must rise quickly.

Buyers of large umbrella towers should be prepared that it is likely that more participants will be needed at your next renewal than has been necessary in the past to build the same total limits as expiring, and some economies of scale with your expiring providers will likely be lost and rise accordingly. Clients of all sizes will see some increase and this is likely to be the case at least through 2020. Feel free to contact Simkiss & Block for more information or to discuss your needs.